Catastrophe bond fund strategies in the UCITS format averaged another month of positive returns in February 2025, but the difference between lower-risk strategies that tended not to have as much exposure to the recent California wildfires and higher-risk funds that tended to be more exposed to the loss event, was clear.

The UCITS catastrophe bond fund strategies averaged a 0.32% return for the month of February, according to the latest data from the Plenum CAT Bond UCITS Fund Indices.

That’s down on the performance seen in January, when the UCITS cat bond fund segment delivered an average return of 0.49%.

But, as we explained in our article at the time, most of that January performance came in the first week of the month, after which the Los Angeles, California wildfire impacts and losses dented returns for many cat bond fund strategies.

February 2025 saw a bit of dispersion between catastrophe bond fund strategies, which we understand was largely caused by how exposed they are to aggregate deals that have been marked-down on rising deductible erosion caused by the wildfires.

As a result, Plenum’s Index for lower-risk UCITS catastrophe bond funds was up by 0.48% for the month, where as the group of higher-risk UCITS cat bond funds only returned 0.14% for February.

It’s important to note that the effects of the wildfire aren’t felt equally, with some lower-risk strategies having slightly worse performance given portfolio mix, and some higher-risk cat bond funds still doing well as they avoided some of the most price impacted positions.

But, in general, higher-risk cat bond funds seemed to have had more exposure to the aggregate cat bond deals that covered the wildfire peril in California, with lower-risk funds (in general) having somewhat less.

We understand that there has also been some dispersion in the performance of catastrophe bond funds year-to-date depending on their size, with a number of larger funds seeming to experience more in the way of price-related effects from the wildfires, compared to some smaller strategies.

There has always been a theory in the market that very large cat bond funds tend to invest across a much greater proportion of the outstanding market, as you’d expect they would need to given it can be harder to be as selective with more assets to deploy. So with an event like the wildfires, some of the larger funds picked up more of the negative price related effects from the aggregate cat bonds this year so far, it seems.

It’s critical to also note that these aren’t realised losses at this stage, being mark-to-market in nature. So, at least some of the aggregate cat bonds that have been marked down after the wildfires will likely make it through the rest of their annual risk periods without attaching or facing actual loss, so some of the January and February mark-down effects will be recovered.

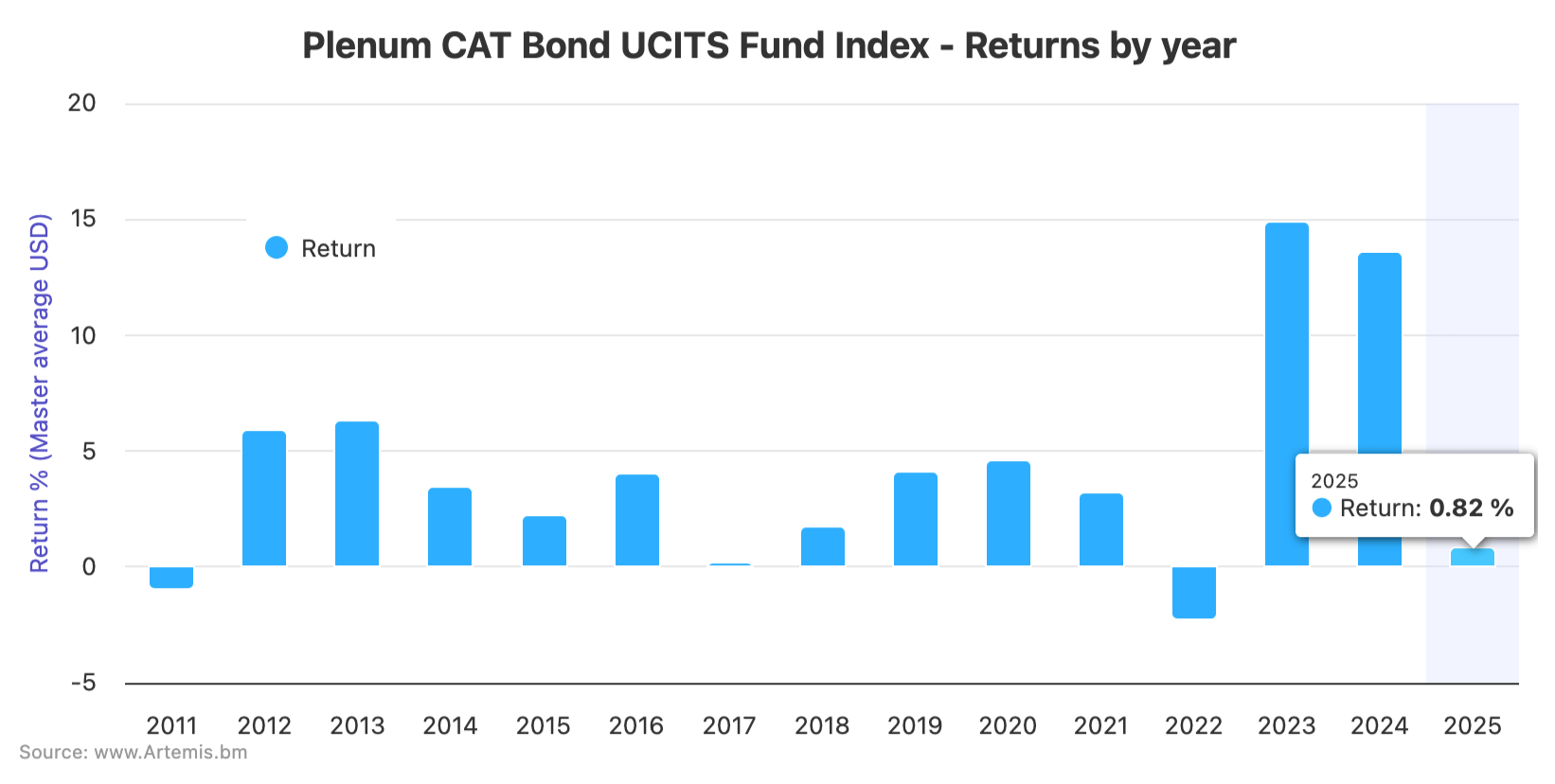

Year-to-date, the average return of the UCITS catastrophe bond funds now stands at 0.82% after February.

Lower-risk cat bond funds have averaged a 0.92% return for the period, while the higher-risk cohort of UCITS strategies delivered 0.65%.

The rolling-twelve month return for the UCITS cat bond funds now stands at 11.56%, which is down on the 12.48% we reported as of the end of January, which shows how the market has been affected by the wildfires, losing 0.92% of its rolling-performance in just two months.

But, again, some of that will be recovered, as it’s currently expected that at least some of the aggregate cat bonds dented by the wildfires will experience price improvements and it’s very unlikely all would face triggering and actual principal reductions.

On the rolling-twelve month basis, lower-risk cat bond funds have delivered an 11.42% return, while the higher-risk UCITS cat bond cohort stand at 11.62% as of the end of February 2025.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using this chart.