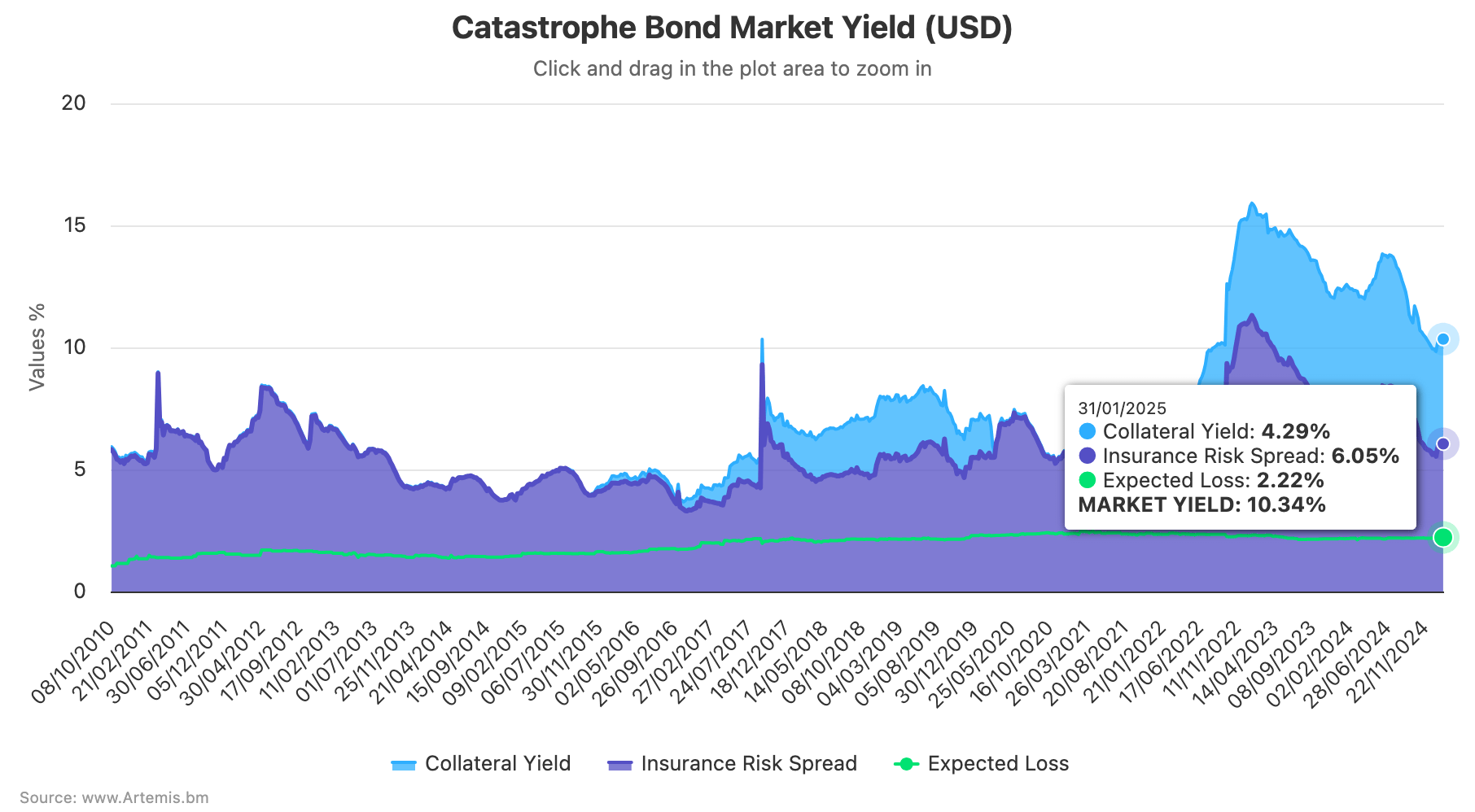

Price adjustments to catastrophe bonds exposed to the California wildfires drove the overall yield of the catastrophe bond market higher in January 2025, to end the month back in double-digit territory, at 10.34% in USD, according to the latest data from Plenum Investments.

But, the expectation is that once the wildfire exposure has been absorbed and accounted for within cat bond pricing, the cat bond market yield will likely return to a weakening trend this month, due to continuing strong demand for cat bond investments.

A month ago we reported that, high-demand for catastrophe bond investments had compressed risk spreads a little, resulting in the overall yield of the catastrophe bond market falling back into single digits at 9.94% by the end of December 2024.

Now, January has seen an additional pressure introduced to the catastrophe bond market, as fund managers and investors absorbed information related to the devastating wildfires in California, their expected insurance and reinsurance industry losses and the potential for certain cat bonds to be affected.

As we reported earlier, the cat bond market’s benchmark index fell by roughly 1% in January, the first negative January in its history.

This was due to the growing number of mark-downs seen across numerous outstanding catastrophe bonds that are deemed to have exposure to the wildfires, either directly or through aggregate attachment erosion.

As a result, as of January 31st 2025, the latest cat bond market yield data currently available, the overall market yield stood at 10.34% and had been as high as 10.47% mid-month, as wildfire price pressures affected the marketplace.

The cat bond mark-downs due to the threat of aggregate attachment erosion and potential losses from the California wildfires were the main drivers of the January spike in insurance risk spreads across the cat bond market and resulting rise in cat bond market yield.

During the month, there was also some spread widening for non-wildfire peril cat bonds as well, as some hurricane catastrophe bonds widened due to a price correction triggered by the lower premiums being paid for that peril in recent cat bond issues, we understand.

But typical spread tightening is expected to resume, as the market finds more balance, albeit at a lower-level.

Specialist catastrophe bond fund manager Plenum Investments noted that “the total yield in the CAT bond market is still at a very attractive level,” at the USD 10.34% level it ended January at.

The investment manager also noted investor appetite is expected to continue pressuring returns, saying that, “we assume that the market return will continue to weaken slightly due to the strong demand for CAT bonds.”

Analyse catastrophe bond market yields over time using this chart.