As May issuance continues to build, including the latest new catastrophe bond issues that are settling today, Artemis’ data on cat bond market issuance has now exceeded the previous record for the first-half of the year, with almost $12.64 billion of tracked deals completed so far in 2025.

Less than one month ago we were talking about catastrophe bond issuance in 2025 being ready to beat the record for first-five-month of the year issuance and now just a few weeks later we’re talking about the half-year and even longer periods of historic market activity being eclipsed.

It is stunning to now see that, cat bond issuance in 2025 has already broken the half-year record and is now destined to break the nine-month record set a year ago and that is going to happen well over three months ahead of last year’s record pace.

With almost $12.64 billion of catastrophe bonds issued and settled as of today, it beats the half-year 2024 record figure of just over $12.61 billion, according to Artemis’ data.

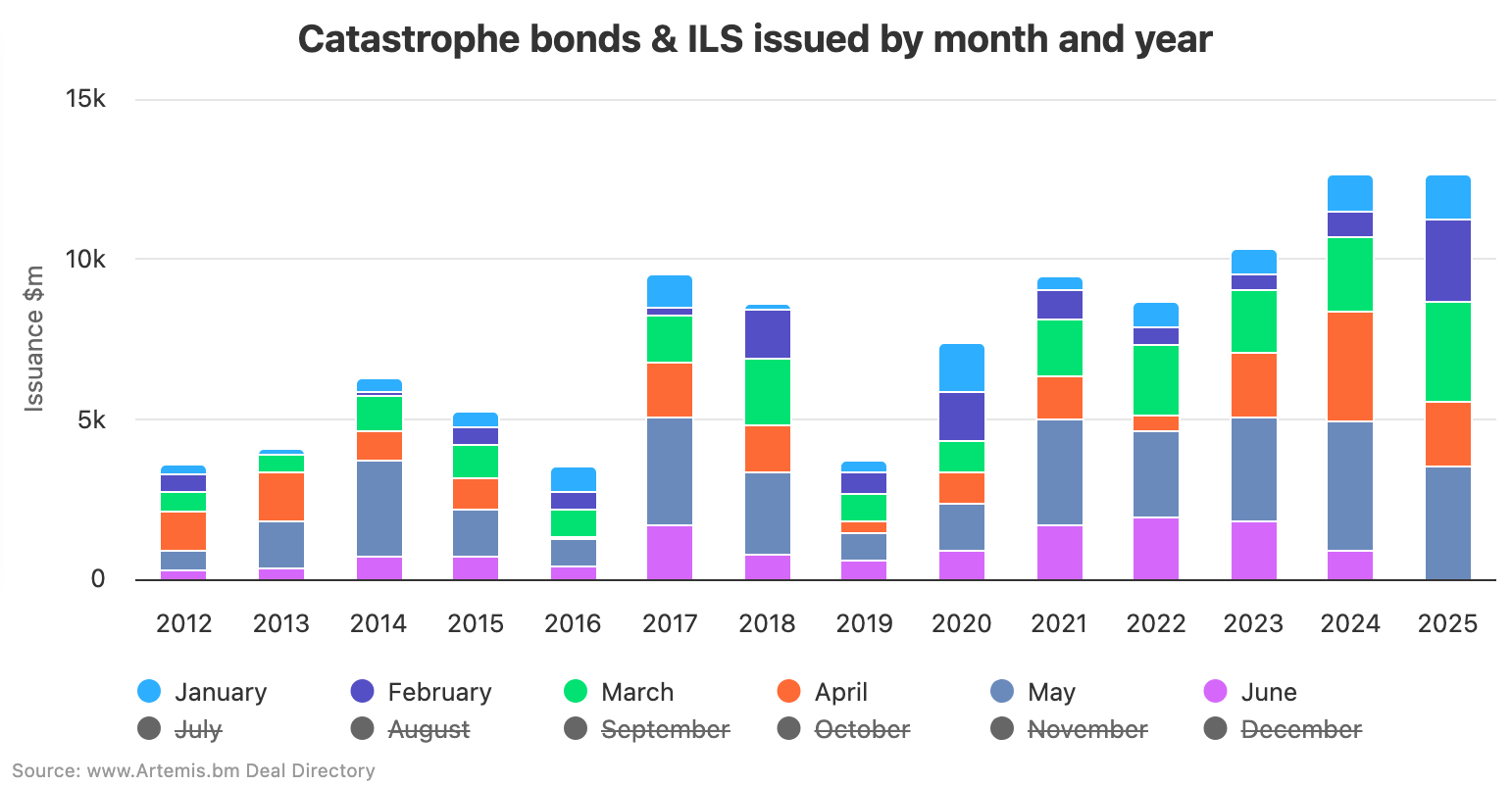

The chart below shows issuance to-date, versus the first-half of prior years. Remember you can select and deselect months at the bottom of the chart to analyse issuance by period using the interactive version here.

As catastrophe bond issuance continues to soar in 2025, the outstanding market size has been growing with it.

At this stage we see our measure of the outstanding marketplace as up by more than 12% year-to-date, at a new high of almost $55.3 billion.

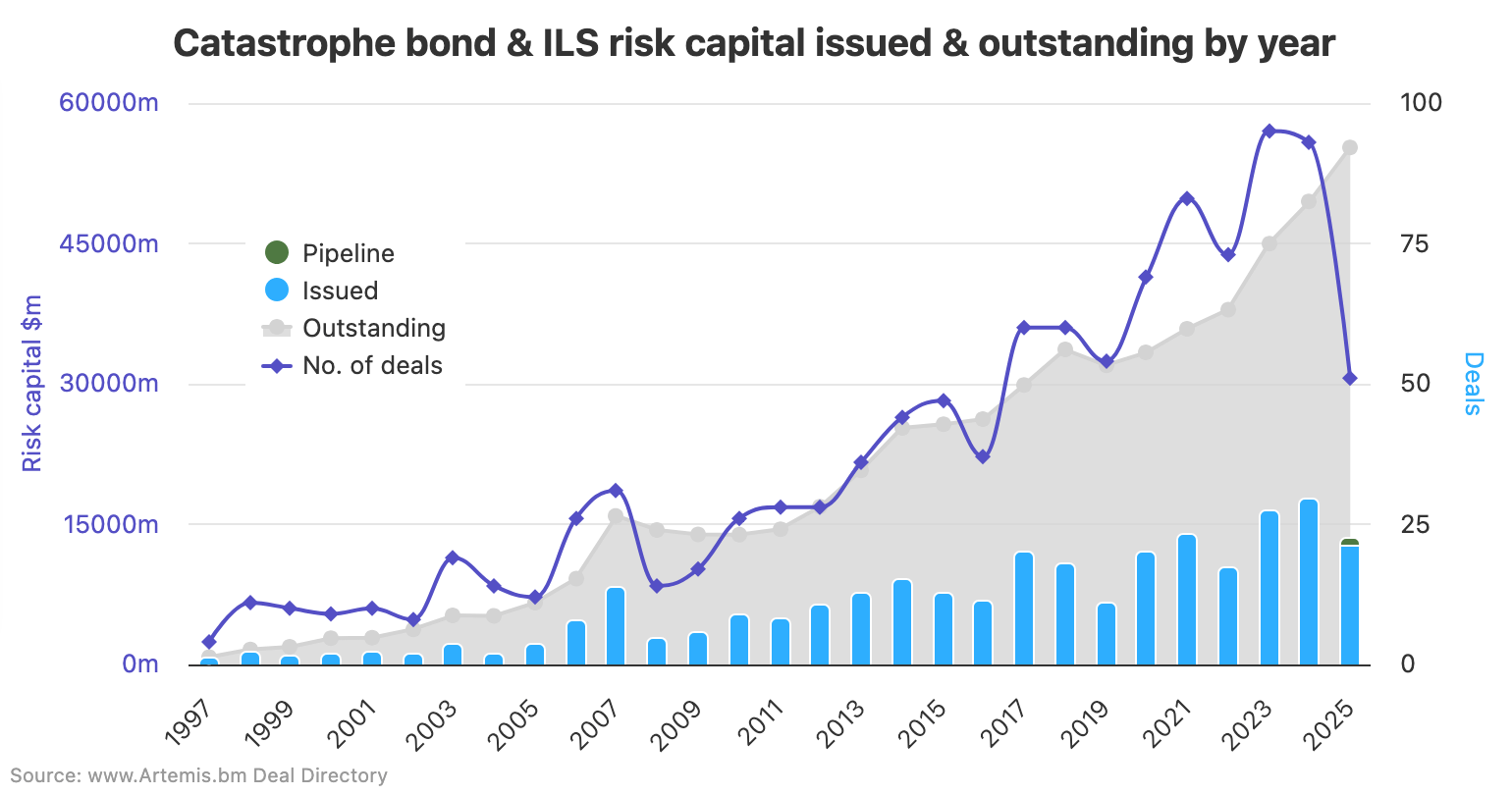

While issuance has been breaking records all the way through this year, there was also a record amount of cat bond maturities to roll-off risk and recycle capital from, which the catastrophe bond market has admirably had no trouble doing.

Impressively, by our data the cat bond market has now grown by 15% since the middle of last year, as of today.

Right now there are a further $926 million of new catastrophe bonds in the market pipeline, so deals we are aware of but that have not yet been settled.

However, the remainder of the second-quarter of 2025 sees a further over $3.4 billion of cat bond maturities scheduled, meaning the market needs to see meaningful issuance if it is to grow further in size from where it stands today by the mid-point of 2025.

That may be a challenge with many of the regular issuers having already brought their deals to market earlier this year. It could take another large cat bond to come to market (State Farm perhaps?) to ensure market growth continues over the coming weeks.

However, the catastrophe bond market will have grown since the start of the year and year-on-year at June 30th 2025, that is already assured thanks to the rapid issuance we’ve seen so far this year.

Analyse catastrophe bond issuance and the size of the market by risk capital outstanding by year in this chart, which also shows the current cat bond pipeline of deals in the market but yet to settle.

At this stage of the year and with already $12.64 billion of tracked catastrophe bond issuance settled and a further $926 million due to settle by the first week of June, it is hard to think that the cat bond market will not set a new annual issuance record in 2025.

The previous record for annual cat bond market issuance, of just over $17.69 billion set in 2024, will only be approximately $4.13 billion of issuance away in early June, leaving close to seven months of the year left for us to see that issuance.

Second-half issuance of cat bonds has been over $5 billion in each of the last two years, so beating the full-year record is certainly possible in 2025. You can analyse this using our interactive chart and by deselecting the first six months of the year.

Of course, there’s a lot that can happen to influence catastrophe bond market activity, not least the impending hurricane season.

But conditions seem primed with new capital, more investors, debut sponsors, an increasingly sophisticated structuring and bookrunning community, and a competitive cost-of-capital versus traditional reinsurance, all of which suggests there’s a strong chance catastrophe bonds continue to set records through the rest of the year.

Stay tuned to Artemis for critical catastrophe bond market insights as the rest of 2025 progresses!

Don’t forget, you can track catastrophe bond issuance and the pipeline of deals due to settle in this chart.

You can track settled cat bond issuance by month and quarter in this chart (use the key of months at the bottom to include and exclude any from your analysis).

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.